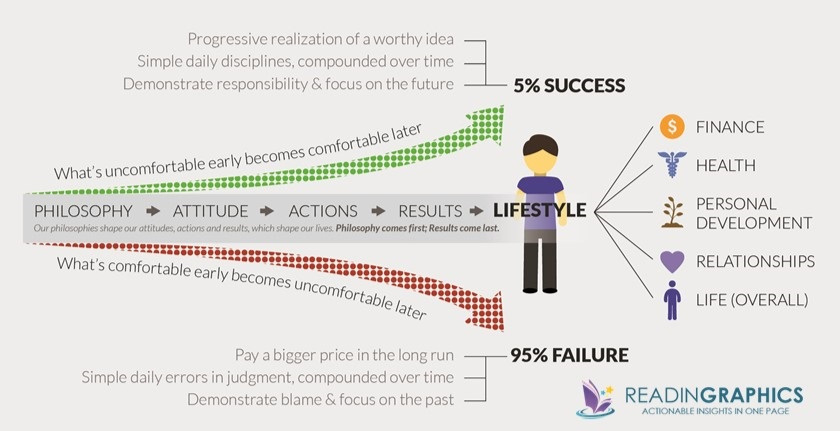

Our choices determine our life paths

Everything, including your life, is a curve.

Your daily choices determine which curve you are on.

What is financial advice?

Financial advice is about far more than just making money. It’s about creating new opportunities to help you achieve whatever you desire in life. A financial planner can help you work out what’s important to you and help you develop a plan that aligns your financial decisions to your lifestyle goals.

Financial planners also know your priorities can change over time, as can economic conditions, legislation and investment markets. They can help re-focus your plan, and track your progress along the way whether you’re starting out, building wealth or planning for retirement.

Seeking financial advice will help you identify solutions to important questions such as:

Will I have enough income to live comfortably in retirement?

Is my family protected should something unexpected happen - what do I need to know about life insurance?

How can I make sure I have enough money to fund my children’s schooling/education?

How can I invest and structure my finances in the most tax effective way?

How can I manage my debt and pay off my home sooner?

How can I make my money work harder for me?

What’s the best structure to protect my investments and assets?

How can I maximise my entitlement to government benefits, ?

What about estate planning?

At its best, financial advice is an ongoing long-term partnership centered entirely on your goals. If you’re weighing up whether financial advice is right for you, consider booking an initial complimentary obligation free appointment.

How We Work

listening carefully to understand you, and to get it right

We are friendly and personally focused and provide tailored wealth management advice.

Whether it’s review or establishment of your wealth creation plans or strategies to meet your needs based on your risk tolerance and personal financial goals, we can assist.

Our approach considers all aspects of your financial circumstances, including your current and foreseeable financial resources and obligations, as well as your lifestyle aspirations for the future.

If we agree that working together will be beneficial for both parties, we’ll commence the process of developing a comprehensive financial and lifestyle plan that’s tailor-made for you.

This provides your with confidence, knowing that all of your financial affairs are managed professionally, removing complexity and providing real peace of mind, so you’re able to enjoy a secure and comfortable financial future.

Guidance, Direction and advice

Antipodean Advisory is a privately owned wealth management and financial services advisory firm. We specialise in providing people from all walks of life with personal, strategic financial advice and tailored wealth management solutions.

Our aim is to help anyone to gain control of their finances and maximise their wealth creation opportunities. We do this by developing a financial roadmap that outlines a clear direction towards long-term wealth creation and financial prosperity.

Become a client

Our process is simple and involves a collaboration between both parties that are focused on enabling you to reach your financial and lifestyle goals.

Our approach is highly personalised and we take the time to get to know you, and to understand your goals and aspirations for the future. Not just where you want to be financially, but also in terms of what you want out of life.

Because life isn’t all about money, it’s also about ensuring that you’re equipped to enjoy the quality of life you desire for you and those you care for now, and well into the years ahead. This is what we call your ‘full financial potential’.

We work hard to gain your trust, aiming to deliver long term strategic value, while operating with the utmost integrity, as we are completely transparent with all fees and costs. You always remain in control, and we only proceed with the strategies we recommend once you are completely satisfied with our advice and recommendations.

Importantly, we provide this tailored service to each of our clients in a completely confidential environment.